Hello, Knoxville community!

At RightWay Insurance, we understand that many of you are feeling the pinch of rising auto insurance rates. We’re committed to finding you the best policies at the most affordable prices by shopping around with multiple carriers. Here’s what’s happening in the auto insurance market and what you can do to save.

Why Are Auto Insurance Rates Increasing?

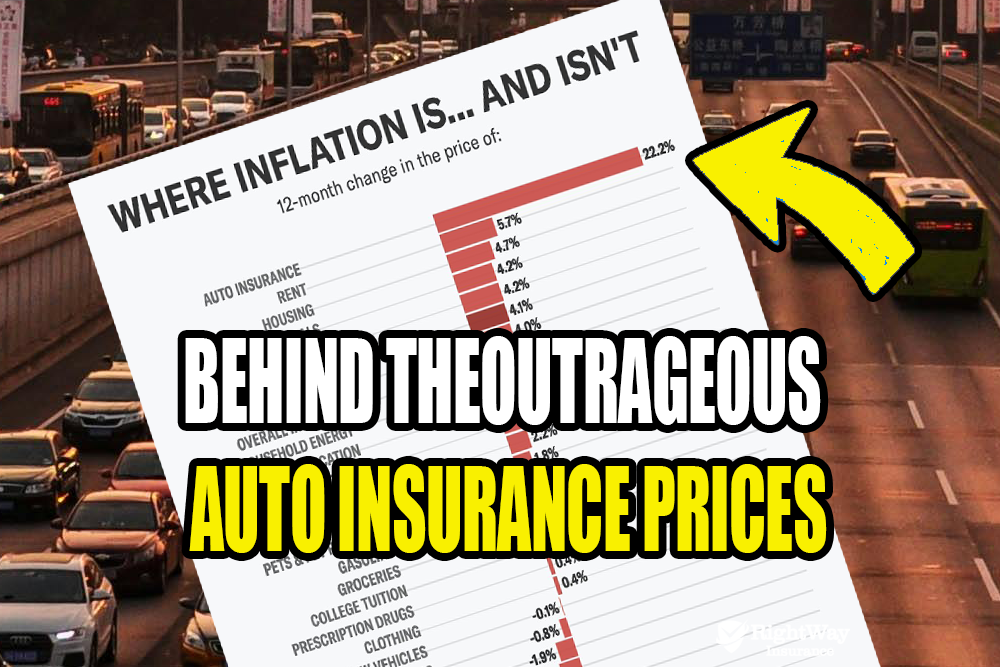

- Historical Rate Increases: Car insurance rates have surged nearly 22% over the past 12 months, a rise not seen since 1976. This significant increase is contributing to the overall inflation rate.

- Rising Repair Costs: Repair costs are up 6.7% for the year. More expensive auto parts and higher wages for mechanics due to labor shortages are driving these costs.

- More Severe Accidents: Post-pandemic, the number and severity of traffic accidents have increased. This has led to higher claims and more involvement from attorneys, which raises costs.

- Climate Change: More frequent natural disasters and severe weather events are leading to larger claims, affecting both auto and home insurance rates.

- Uninsured Drivers: Approximately 13.3% of drivers in the U.S. are uninsured, adding to the financial strain on insured drivers and insurers alike.

- Risky Driving Behaviors: Speeding, texting while driving, and driving under the influence are contributing to the rise in claims.

- Auto Theft Rates: Auto thefts have surged, with a 34% increase in the first half of 2023 compared to 2019.

Tips to Save on Auto Insurance

While rates are increasing, there are several ways you can manage your premiums:

- Assess Your Coverage Needs: Ensure your coverage fits your current situation. Adjust your policy based on your net worth, risk tolerance, and other factors.

- Maintain a Clean Driving Record: Avoid accidents and traffic violations to prevent rate hikes.

- Choose a Cheaper Car: Some vehicles are less expensive to insure. Consult with us before buying a new car.

- Shop Around: Compare quotes from different insurers. This is why we are here! RightWay Insurance helps you find the best rates by shopping with multiple carriers.

- Consider Telematics: Use devices or apps that monitor driving habits for potential discounts.

- Maximize Discounts: Look for discounts for students, seniors, military personnel, and safe drivers.

- Bundle Insurance: Combine auto and home insurance for bigger discounts.

- Improve Your Credit Score: A better credit score can lower your insurance rates.

- Avoid Reducing Coverage: Instead of reducing coverage, try raising your deductible or enrolling in paperless billing.

At RightWay Insurance, we’re here to help you navigate these challenging times. Contact us today to find the best policy for your needs and budget. Together, we’ll ensure you’re well-protected at an affordable rate.

Stay safe, Knoxville!

Best regards,

The RightWay Insurance Team